Manulife MPF members to benefit from management fees reduction as a result of greater efficiency through scheme restructure

For Immediate Release

August 1, 2018

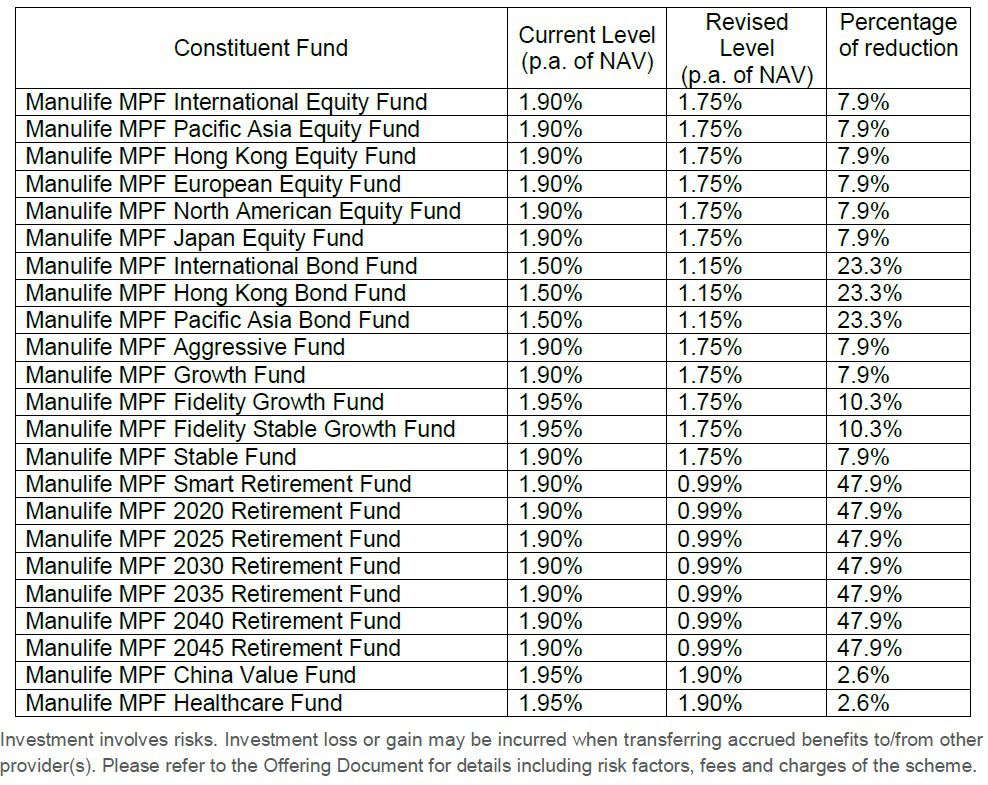

Hong Kong – Effective August 1, 2018, Manulife MPF members will benefit from the management fee reduction exercise, under which the management fees for 23 constituent funds across equity, bond, guaranteed and mixed-asset categories of the Manulife Global Select (MPF) Scheme (“Manulife Global Select”) will be lowered by a range of 2.6% to 47.9%.

Manulife currently has three MPF Schemes, namely Manulife Global Select, Manulife MPF Plan – Basic (“Manulife Basic”), and Manulife MPF Plan – Advanced (“Manulife Advanced”), offering a total of 64 constituent funds to its MPF members. To streamline the administration of these three schemes, both Manulife Basic and Manulife Advanced will be merged into Manulife Global Select in view of the latter’s comprehensive fund options. As a result of this scheme restructure, greater operation efficiency and enhanced cost-effectiveness will be achieved and Manulife is passing back the benefits to its MPF members by means of management fees reduction.

“Members’ interests are always at our heart as we pride ourselves as a customer-centric company. This philosophy also echoes the MPFA’s Governance Charter for MPF Trustees in relation to offering value-for-money MPF schemes and services and acting in the best interests of members,” said Raymond Ng, Vice President and Head of Employee Benefits, Manulife Hong Kong. “We are pleased to share with our MPF members our savings from the restructure through this fee reduction exercise.”

At the end of June 2018, Manulife continued to lead in the MPF market as the No. 1 MPF scheme sponsor in Hong Kong -- with a market share of 22.6%1 in terms of assets under management.

As the largest MPF scheme sponsor in Hong Kong1, Manulife takes active steps to lead the industry in giving back to the community. The Company has launched the “Manulife MPF Caring Campaign” in August, an initiative to encourage its Personal Account (“PA”) members to participate in blood and organ donation in Hong Kong by rewarding them with a special upgrade in the level of privilege they enjoy under the Company’s Privileged Rates Program.

“Manulife has a long history of supporting blood donation in Hong Kong, and we are proud to take the lead to reward our PA members for their generous cause. Our program also backs the government’s call for active support for organ donation. As a company with a strong caring culture, we are delighted to mobilize our staff, financial advisors and customers to give back to the community,” Mr. Ng said.

From August 1 to October 31, 2018, Manulife's PA members can submit a declaration form along with either a copy of signed organ donation card or registration form or the appropriate documentation showing they have donated blood at least twice by October 31, 2018. Upon successful receipt of the documents, the members will be rewarded with a one-off “two levels” upgrade under the Privileged Rates Program (subject to terms and conditions), which will take effect from January 2, 2019.

Launched in 2012, the Privileged Rates Program is a unique reward scheme based on the length of the Manulife MPF relationship and the amount of aggregated MPF assets for providing special offer on the management fees of selected constituent funds by way of bonus units. The longer an MPF member stays with Manulife and the more MPF assets they maintain with Manulife, the better the privileged rates on the management fees of selected constituent funds they may enjoy (subject to terms and conditions).

For more details about Manulife Global Select and the Privileged Rates Program, please visit here.

The details of the revised management fees of the 23 constituent funds under Manulife Global Select are shown below:

1Source: “Mercer MPF Report” as at June 30, 2018 by Mercer (Hong Kong) Limited, in terms of market share of total MPF assets by scheme sponsor.