Default Investment Strategy

Quick guide to Default Investment Strategy

The MPF Default Investment Strategy (“DIS”) was introduced by the Mandatory Provident Fund Schemes (Amendment) Ordinance 2016, which requires every MPF scheme to provide the DIS to members with effect from 1 April 2017.

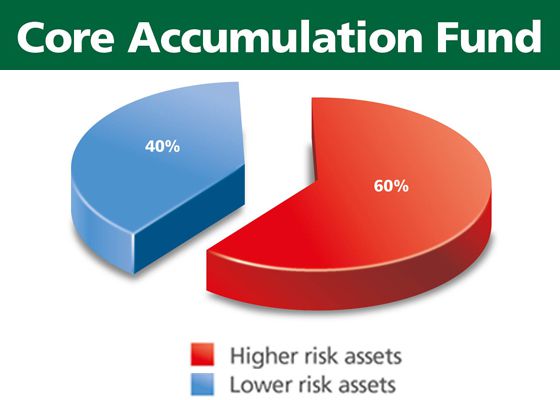

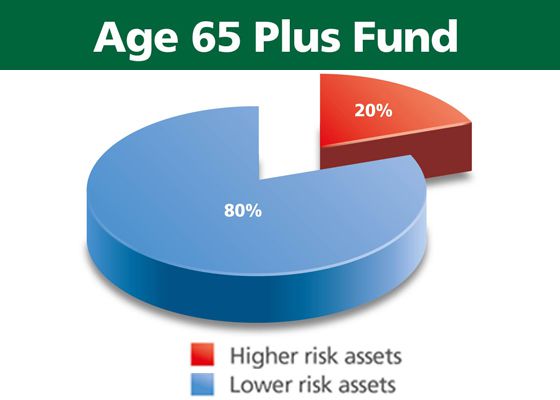

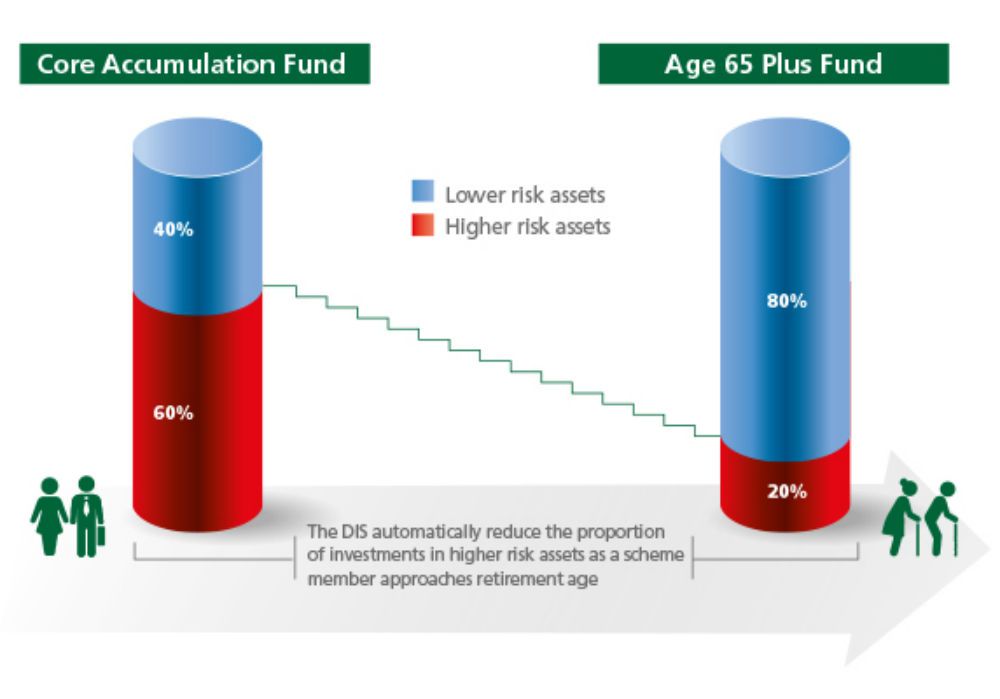

Each MPF scheme is required to provide two constituent funds, indicated as the Core Accumulation Fund and the Age 65 Plus Fund. These two constituent funds will be invested globally in a diversified manner, but their risk exposure is different due to the difference in the composition of higher risk assets (such as equities) and lower risk assets (such as bonds and money market instruments).

The charts below show the target asset allocation of these two constituent funds in terms of higher risk assets and lower risk assets as required by law. Please note that the actual distribution in higher risk assets and lower risk assets at any time may deviate from the target asset allocation, up to a maximum of plus or minus 5% mainly due to market fluctuations.

The Core Accumulation Fund and the Age 65 Plus Fund are subject to fee caps by law, with management fees and recurrent out-of-pocket expenses not allowed to exceed 0.75% and 0.2% respectively of the net asset value of these two constituent funds on a yearly basis.

DIS allocation percentages and annual de-risking

The DIS will be invested in the Core Accumulation Fund and the Age 65 Plus Fund according to a member’s age.

Under the DIS, new contributions (including transferred-in monies) will be automatically invested according to the allocation percentages stated in the table below. When the member gets older between the ages of 50 and 64, new percentages will automatically apply each year.

Existing accrued benefits investing in the DIS will also be automatically adjusted once every year when the member is between the ages of 50 and 64 in order to meet the allocation percentages between the two constituent funds stated in the table below. The adjustment will be carried out by way of fund switching between the Core Accumulation Fund and the Age 65 Plus Fund.

The automatic adjustment on the investment of existing accrued benefits to gradually reduce the exposure to higher risk assets and correspondingly increase the exposure to lower risk assets as the member gets older is called “annual de-risking”. The annual de-risking will be carried out automatically on the date of the member’s birthday (or the next available dealing day if such date is not a dealing day) regardless of the prevailing market conditions.

Eventually, all accrued benefits and new contributions (including transferred-in monies) will be invested in the Age 65 Plus Fund when the member reaches the age of 64.

Click here for the details of the DIS De-risking table

DIS De-risking Table

| Age | Core Accumulation Fund | Age 65 Plus Fund |

|---|---|---|

| Below 50 | 100% | 0% |

| 50 | 93.3% | 6.7% |

| 51 | 86.7% | 13.3% |

| 52 | 80.0% | 20.0% |

| 53 | 73.3% | 26.7% |

| 54 | 66.7% | 33.3% |

| 55 | 60.0% | 40.0% |

| 56 | 53.3% | 46.7% |

| 57 | 46.7% | 53.3% |

| 58 | 40.0% | 60.0% |

| 59 | 33.3% | 66.7% |

| 60 | 26.7% | 73.3% |

| 61 | 20.0% | 80.0% |

| 62 | 13.3% | 86.7% |

| 63 | 6.7% | 93.3% |

| 64 and above | 0% | 100% |

The allocation percentages stated in the table will apply to the existing accrued benefits on the date when the annual de-risking is carried out. However, the percentages of investment between the Core Accumulation Fund and the Age 65 Plus Fund may vary at any other time during the year due to market fluctuations.

DIS as the default investment arrangement

The DIS is the default investment mandate applying to any type of new MPF account set up on or after 1 April 2017 where no or invalid investment instruction is given by the member.

For example, when an employee ceases employment, the accrued benefits in the contribution account during employment may be transferred to a Personal Account. If the Personal Account is a new account set up on or after 1 April 2017 as a result of automatic transfer of accrued benefits from the contribution account, the DIS will be set as the investment instruction for such Personal Account for future transferred-in monies from another scheme unless the employee has given an investment instruction otherwise.

DIS as one of the investment options

The DIS is also available as one of the investment options. Members can choose to invest in the DIS or choose any of the constituent fund(s) (including the Core Accumulation Fund and the Age 65 Plus Fund as standalone investments) and specify their own preferred allocation percentage in each constituent fund. If members choose the DIS, the contributions (including transferred-in monies) made to their account will be invested according to the DIS allocation percentages and annual de-risking mentioned above.

If members choose to invest in the Core Accumulation Fund and/or the Age 65 Plus Fund as standalone investments by specifying their own preferred allocation percentage(s), the annual de-risking will not apply.

Possible risks associated with investing in the DIS

The DIS does NOT guarantee the capital and investment returns and members may encounter loss on their investment in the DIS. Due to the characteristics of the DIS, there are risks associated with investing in the DIS such as:

- The DIS does not take into account factors other than age, such as market and economic conditions nor a member’s personal circumstances including investment objectives, financial needs, risk tolerance or possible retirement date.

- The Core Accumulation Fund and the Age 65 Plus Fund each must follow the prescribed asset allocation in higher risk assets and lower risk assets at all times and thus it will limit the ability of the investment manager to adjust the asset allocation in response to sudden market fluctuations. In addition, the investment holdings in each of these two constituent funds may have to be continuously rebalanced, i.e. sell and buy, in order to meet the prescribed asset allocation regardless of the views of the investment manager.

- The annual de-risking which involves fund redemption and subscription will normally be carried out on the date of a member’s birthday (or the next available dealing day if such date is not a dealing day) regardless of the prevailing market conditions.

- The DIS may incur greater transaction costs than a constituent fund with more static asset allocation for the latter. This is due to the required rebalancing between higher risk assets and lower risk assets and the annual de-risking for DIS.

Whether members are investing in the DIS or any of the constituent funds, they may change their investment at any time to meet their changing needs.

Annual de-risking and other instructions

When one or more instruction(s) such as subscription, redemption and/or switching instructions are to be processed where units are issued by and/or redeemed from or monies are invested to and/or withdrawn from the constituent fund(s) in respect of a member’s account, and at the same time, such day is the day of annual de-risking, both these instruction(s) and the annual de-risking will be processed on the same dealing day with the annual de-risking takes place after processing these instruction(s).

Features of DIS

The information above is intended to provide a brief summary about the DIS and the possible impacts on your MPF account for reference only and you should not make your investment decision based on such information alone. Please refer to the MPF Scheme Brochure and Key Scheme Information Document (KSID).

If you have any queries on the DIS, please call our Member Hotline on (852) 2298 9000 (service hours: Monday to Friday 9am - 6pm, Saturday 9am – 1pm, closed on Sundays and Public Holidays).

You may also visit the website of the Mandatory Provident Fund Schemes Authority at for more information about the DIS.

Warning: Investment involves risks. Please refer to the MPF Scheme Brochure and Key Scheme Information Document (KSID) for details including risk factors, fees and charges of the scheme.